Dollar Coast Averaging (DCA) is an speculation methodology that includes methodicallly contributing an sum of cash with which you’re fiscally comfortable over steady periods in arrange to diminish the normal share cost you pay in connection to the normal showcase cost of the offers. You contribute the same sum whether the advertise is rising or falling. 1 Rather than contributing a protuberance whole all at once, you make customary fixed-dollar ventures at foreordained intervals.

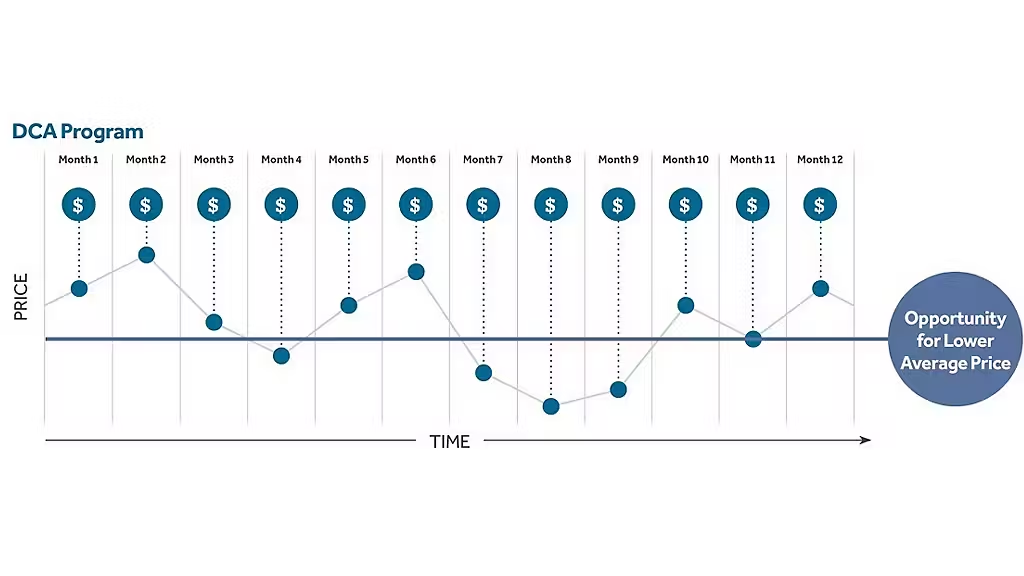

Dollar Coast Averaging illustration

Attempting to time the showcase and contribute when costs are moo can be challenging and unsafe. Dollar taken a toll averaging addresses this issue by consequently contributing the same sum over time, in this way buying more offers of an resource when costs are moo and less when costs are tall.

Preferences of dollar coast averaging

Dollar coast averaging offers a few preferences for speculators who are looking to construct their portfolios over time.

1. Decreased affect of advertise timing

Attempting to time the showcase can be troublesome indeed for experienced speculators, but reliably contributing settled sums over time can assist you maintain a strategic distance from making huge speculations when cost focuses are higher. Of course, dollar-cost averaging does not guarantee a benefit or dispose of the dangers of contributing.

2. Passionate teach

Dollar fetched averaging gives a more restrained approach to contributing, and it can offer assistance financial specialists make less drive choices based on short-term showcase vacillations or passionate responses to advertise news.

3. Lower normal buy cost

Since you naturally purchase more offers or units of an resource with dollar fetched averaging when costs are lower and less when costs are tall, this leads to a lower average buy cost over time. This might possibly increment your generally picks up on the off chance that the advertise patterns upward.

4. Decreased affect of instability

This strategy’s normal contributing plan implies you’re buying amid both bull and bear markets, decreasing the hazard of making a huge venture right some time recently a advertise downturn.

5. Straightforwardness and consistency

Dollar fetched averaging could be a direct speculation procedure. You set up mechanized investments, and they happen on a normal premise without your requiring to screen always or make visit choices. This moreover reduces the push and uneasiness related with timing the showcase or making expansive lump-sum ventures.

6. Long-term viewpoint

Dollar-cost averaging energizes speculators to require a long-term view of their speculations. This will possibly empower you to advantage from the compounding of intrigued amid any expanded advertise upturns. Of course, it’s moreover conceivable to lose cash in a dollar-cost averaging program.

7. Openness

It’s accessible to financial specialists with different levels of money related assets. You’ll begin with littler venture sums and increment them as your budgetary circumstance makes strides.

8. Steady investment funds

This serves as a way for you to spare since it empowers you to routinely contribute to your venture portfolio. Usually especially important for those who discover it challenging to spare noteworthy entireties.

9. Joining into your monetary technique

You’ll effortlessly consolidate dollar fetched averaging into your money related arranging, which makes it appropriate for retirement accounts, college reserve funds plans, and pursuing other long-term budgetary objectives.

Variable all inclusive life venture

Variable widespread life offers life protections security and the opportunity to develop tax-advantaged resources within the advertise. For more prominent certainty, the Unused York Life Variable Widespread Life Aggregator II offers two extraordinary dollar taken a toll averaging accounts that offer a ensured interest rate as your cash holds up to enter the market. Variable widespread life protections gives a life protections advantage in trade for adaptable premiums. The policy’s cash esteem will vacillate with speculation picks up or misfortunes. Mortality-and-expense chance charges, cost-of-insurance charges, per thousand confront sum charges, month to month contract charges, finance expenses, and pertinent yield charges apply. If you don’t mind carefully consider the venture destinations, dangers, charges, and costs some time recently contributing. This and other data can be found within the item and basic reserves outlines. It would be ideal if you perused the outlines carefully some time recently contributing or sending money.

DCA Plus Account

Win a ensured interest rate on resources within the account as they wait to enter the advertise within the to begin with 12 months of your policy. The rate is subject to alter at any time, but it’ll never be less than an yearly rate of 2%. Your Modern York Life monetary administrations proficient can tell you what the current rate is.2

DCA Extension Account

Win a ensured intrigued rate on resources within the account—up to the conclusion of year 7 of your policy—as they hold up to enter the advertise. This account is accessible for premiums of $10,000 or more. The rate is subject to alter at any time, but it’ll never be less than an yearly rate of 2%.